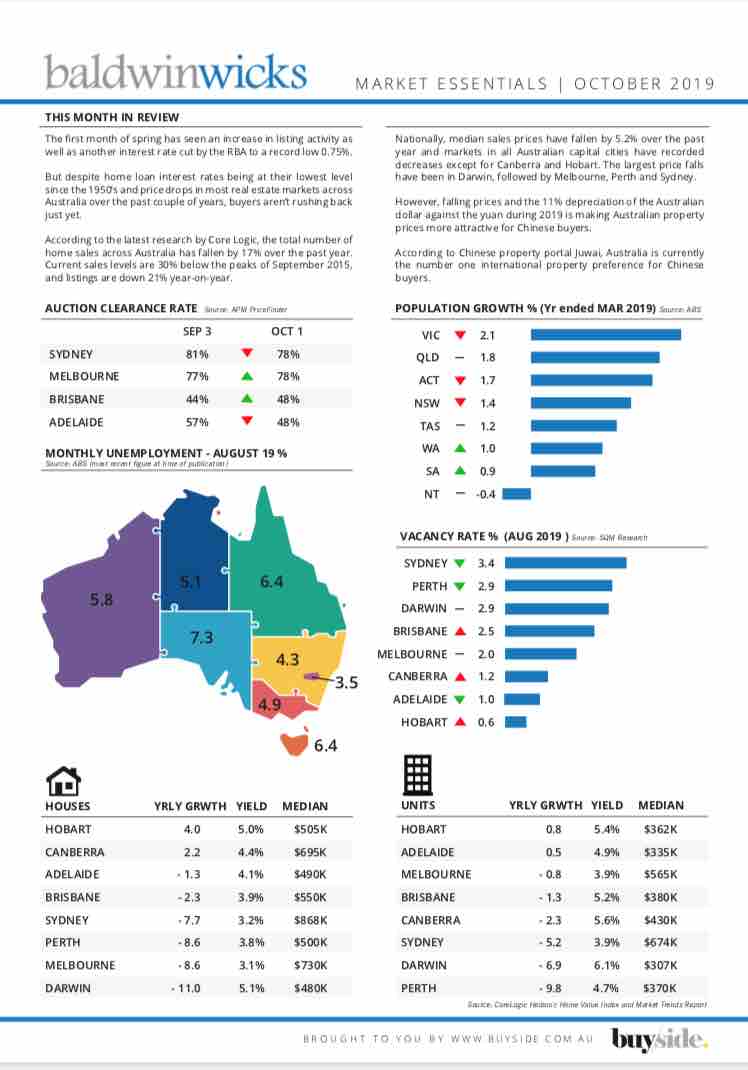

The first month of spring has seen an increase in listing activity as well as another interest rate cut by the RBA to a record low 0.75%.

But despite home loan interest rates being at their lowest level since the 1950’s and price drops in most real estate markets across Australia over the past couple of years, buyers aren’t rushing back just yet.

According to the latest research by Core Logic, the total number of home sales across Australia has fallen by 17% over the past year.

Current sales levels are 30% below the peaks of September 2015, and listings are down 21% year-on-year.

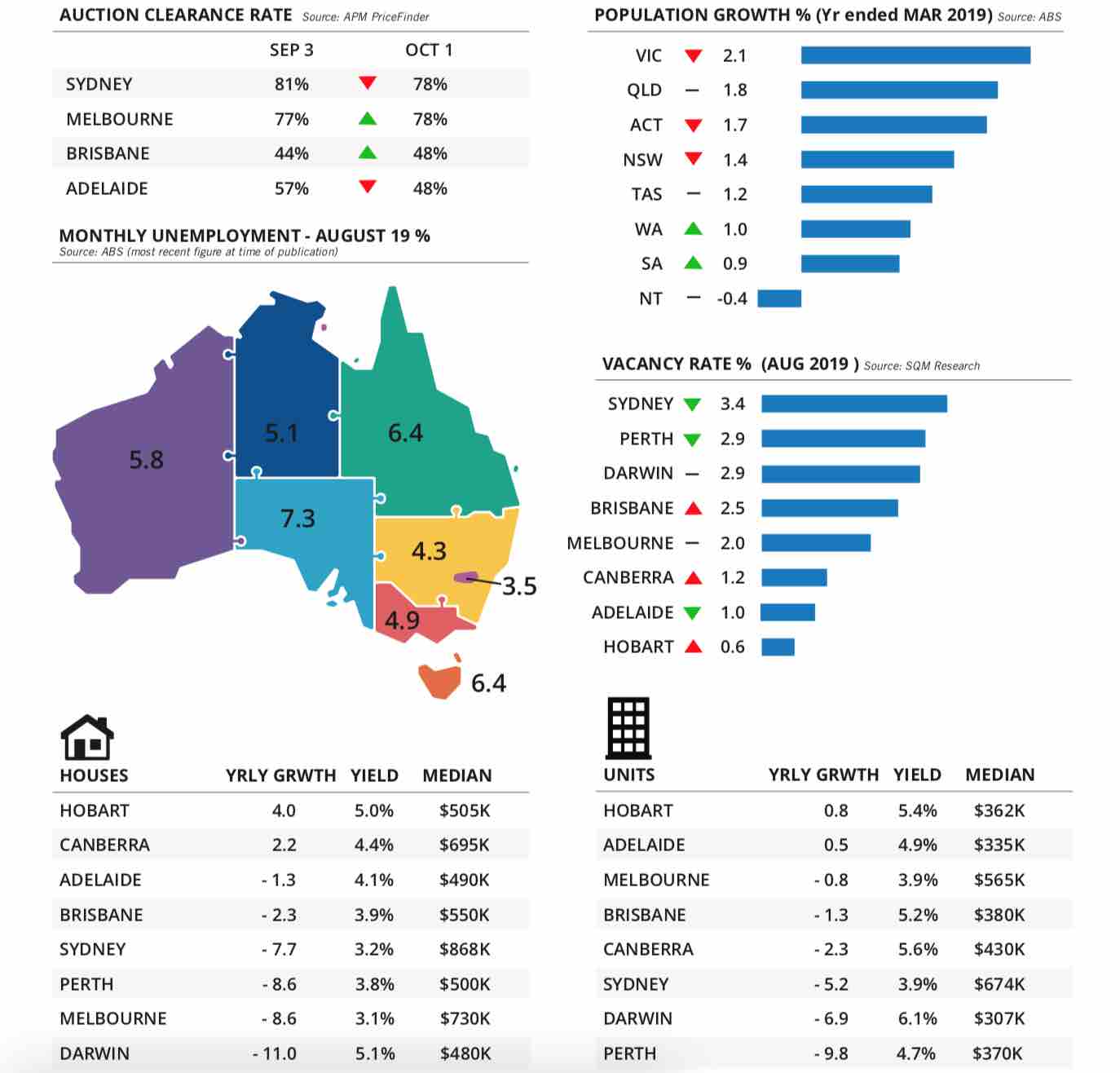

Nationally, median sales prices have fallen by 5.2% over the past year and markets in all Australian capital cities have recorded decreases except for Canberra and Hobart. The largest price falls have been in Darwin, followed by Melbourne, Perth and Sydney.

However, falling prices and the 11% depreciation of the Australian dollar against the yuan during 2019 is making Australian property prices more attractive for Chinese buyers.

According to Chinese property portal Juwai, Australia is currently the number one international property preference for Chinese buyers.

CAPITAL CITY PROPERTY UPDATE

SYDNEY

- Despite the general drop in property market values in the last two years, the median price of a Sydney home is still easily the most expensive in Australia at $885,000.

- Some suburbs have bucked the price drop trend, with the latest real estate.com.au figures revealing double-digit growth in median values over the past year for properties in Vaucluse (24%), Collaroy (15%), Summer Hill (14%), Rose Bay (11%) and Palm Beach (11%). Other solid performers have been Balgowlah (9%) and Bondi Junction (8%).

- Sydney’s unit/apartment market is still being affected by oversupply and a lack of confidence after building defects were detected in several larger new developments over the past year.

MELBOURNE VIC

- According to the latest Domain data, the average current discount off the initial listing price to make a sale is $20,000 for houses and $10,000 for units/apartments in Melbourne. In January of this year, the discount was $100,000 for houses and $60,000 for units/apartments.

Cash Rate Forecast % - The start of spring has seen the total number of property listings in Melbourne increase by 31% over the last month, but the number is still 15% lower than this time last year.

0.5 - According to Chinese property portal Juwai, Chinese buyers are currently making 83% more enquiries about Melbourne than they are for Sydney, and more than 50% of potential Chinese buyers identify Melbourne as their preferred property buying location.

BRISBANE QLD

- The average length of time on the market for Brisbane from listing to sale is currently 81 days for houses and 86 days for units/apartments. The number of new listings is down 16.6% year-on-year.

- Brisbane remains one of the most affordable capital city markets in Australia. According to the latest Core Logic research, only 8.7% of houses in Brisbane are valued at over $1 million, compared to Sydney (30.2%), Melbourne (23.1%), Canberra (11%) and Perth (10%)

- Brisbane shared top spot with Melbourne as the most desirable property investment location in Australia in the latest Finder RBA Cash Rate Survey of property experts and economists.

PERTH

- The latest Core Logic research shows that Perth property owners are holding onto their homes for longer. Houses are changing hands every 11 years on average (compared to 6.2 years 10 years ago), while units/ apartments are currently being held for 10.8 years (compared to 5.9 years a decade ago).

- The Core Logic data also reveals that average Perth property prices are currently 20.6% lower than their previous peak in June 2014.

- Properties in Perth’s south-east, south-west and inner-city suburbs have been the hardest hit by the current property downturn. In the last three months alone, south-east suburb properties have dropped in value by an average of 10.3%, those in south-west suburbs by 9.7%, and inner-city properties by 10.3%.

CANBERRA ACT

- Canberra is currently bucking the national trend of declining real estate prices. The increase over the past year has been driven by a small rise in house prices which have offset a slight decrease in unit / apartment prices.

- The latest realestate.com.au figures reveal that the most in-demand Canberra suburbs are Wanniassa, Ainslie, Evatt, Kaleen and Higgins.

- The latest Domain Property Price Forecast report predicts that Canberra property prices will continue to grow by between 4 and 6% in 2020.

ADELAIDE SA

- According to the latest Australian Bureau of Statistics (ABS) preliminary figures, established house sales in Adelaide for the last quarter were their lowest in 17 years. 3168 Adelaide properties were sold, which is 636 fewer than the previous record quarterly low.

- The ABS data also reveals that the total number of Adelaide unit/apartment sales for the last quarter (1,510) was the lowest number since the March quarter of 2014.down for September Source: Westpac-Melbourne Institute

- According to Housing Industry Association Chief Economist Tim Reardon, the downturn in the total number of sales is due to “homeowners holding onto their nest egg amid lower prices”.

DARWIN NT

- Darwin has recorded the largest decrease (9.7%) in property prices of any Australian capital city over the last year, according to Core Logic. This decrease continues a long-term downward trend. Median prices were 26% higher at the peak of the market in 2013.

- Core Logic data also reveals that Darwin now has the cheapest median prices of any Australian capital city for both houses ($480,000) and units/apartments ($307,000).

- Darwin is also currently providing the highest investment property yields for both houses (5.1%) and units/apartments (4.7%).